Metal Market Brief: December 2022

With these regular updates, we seek to paint a clearer picture of the myriad factors impacting supply and demand of stainless steel and special alloys which–ultimately–affect the price and availability of our products.

Steelmaking Surcharges

Steelmakers use a base-plus-alloy surcharge pricing structure to accommodate the wide variability in input costs. While base prices remain relatively stable, often locked in by long-term contracts, surcharges are adjusted monthly to reflect the volatility in raw material and, increasingly, energy prices.

In our previous Market Brief, we discussed the March spike in nickel prices and its impact on the cost of stainless steel. Producers sought to recover costs above “normal” through elevated surcharges. For instance, North American Stainless issued a $2.1484/lb. surcharge on its 316/316L product in April, a 15.4% month-on-month increase.1 Surcharges peaked in May before falling back in line with levels seen before the spike.

Beyond raw material inputs–which include chromium, molybdenum, manganese, and iron ore in addition to nickel–energy has become part of the pricing matrix.

The Impact of Energy Costs

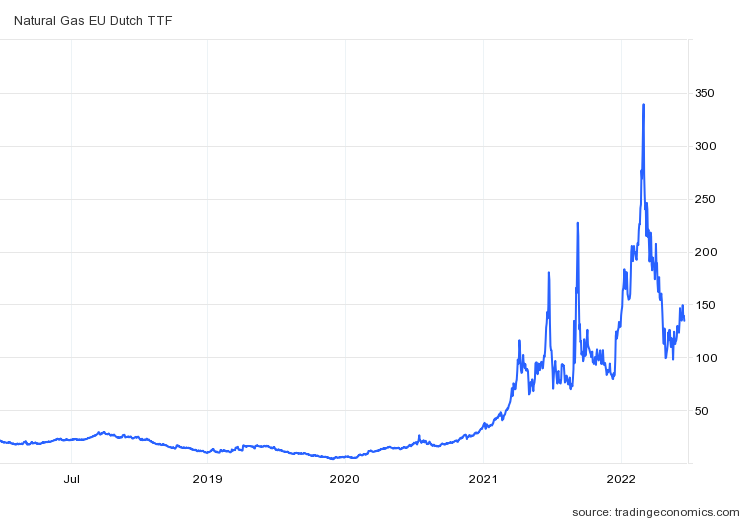

Rising energy costs are a concern for European mills especially. The continent relied heavily on Russian natural gas to the tune of 40% of its annual supply.2 Dwindling and subsequent shutoff of flow from Nord Stream 1 came when supply shortages in the face of increasing demand were already being felt as economies re-opened post-pandemic on the heels of an unseasonably cold winter in 2021. Prices soon climbed into uncertain territory.

The chart below shows the cost of natural gas via forward month Dutch TTF Natural Gas Futures over the past five years. It shows prices hovering between 10-25 EUR/Mwh until 2021. Prices peaked in August 2022 at 339 EUR/Mwh and at time of writing this brief on December 12, 2022, stand at 134.5 EUR/Mwh, a relaxation but hardly a reversion to the mean.3

The departure from previously reliable low-cost energy has encouraged steelmakers to incorporate energy into their surcharge pricing models. Average energy surcharges issued by British stainless steel long product manufacturers fell for the first time last month since July.4

However, with the situation far from certain, firms are taking additional measures to reduce the impact of energy costs on their bottom line. Worried its annual energy bill of £110,000 could reach £400,000 at current consumption levels, Leeds-based Pland Stainless distributed more “thermally efficient” clothing to its staff as it turned the heat down a few degrees.5

US Enjoys Relatively Cheap Energy

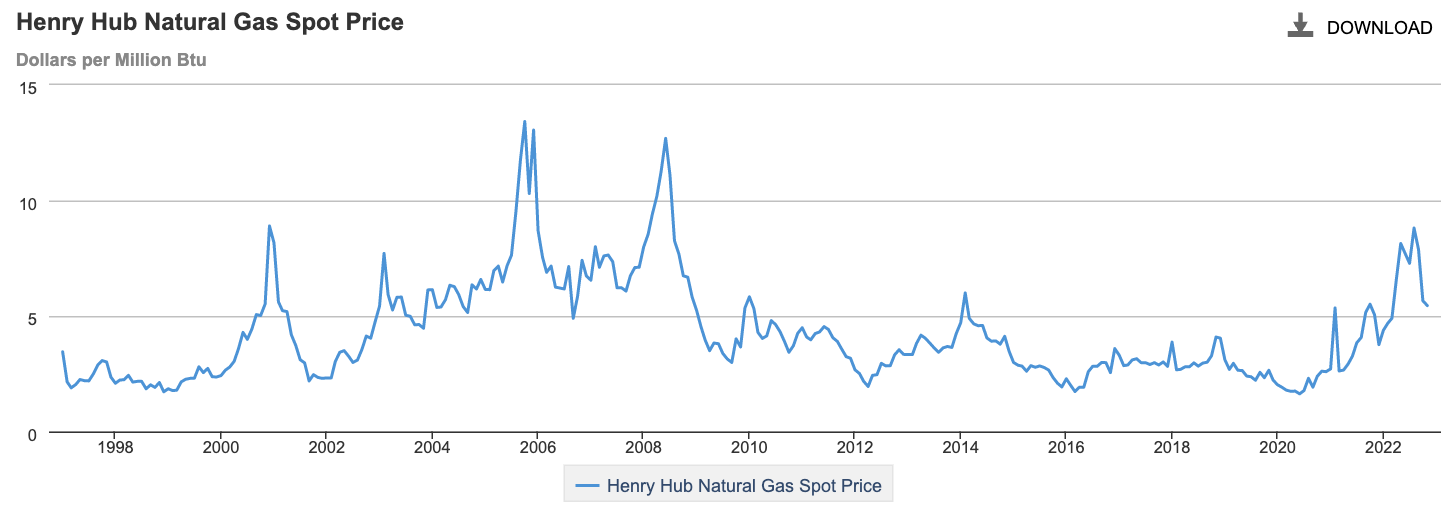

Henry Hub prices are recognized as the benchmark for US natural gas prices. For the week of December 2, 2022, spot prices were 6.06 USD/MMBtu.6 This equates to 19.58 EUR/Mwh.

Energy prices may be included in US surcharges, but do not have the same impact on pricing as they do in Europe. For example, Cleveland Cliffs issued a November surcharge for 316/316L precision strip less than or equal to .015” thick of $1.6565/lb. Natural gas accounted for just $.0157/lb., or less than 1%, of the total.7

Albeit on a different scale, energy prices have fluctuated more than normal in the US as well. The U.S. Energy Information Administration recently released their expectations for higher wholesale energy prices this winter in every region of the country. Figures they shared included an anticipated 31% increase in the Southwest and a 60% increase in the mid-Atlantic and Central regions.8

A Checkered Report: Stainless Steel Demand in 2022

Brussels-based research and development association worldstainless expects a 0.6% reduction in stainless steel consumption globally in 2022.9 To be sure Europe is battling higher-than-usual energy prices and dealing with the war in Ukraine while the Fed’s continued pursuit of higher interest rates makes many in the US weary, but the most significant driver of decreased demand is China’s slowing economy.

Chinese consumption is expected to decline 2.3% in 2022, the first year-on-year fall since 2008.10 Production has slowed along with consumption in large part due to the country’s zero-Covid policy.

In addition to being the world’s largest consumer of both steel and stainless steel, China is also its largest producer. Six of the world’s ten largest steel makers are Chinese entities. The country was responsible for 52.9% of all steel and 56.0% of all stainless steel production in 2021.11 12 This is to say that what happens in China influences global statistics and perspectives on the industry as a whole to a significant degree.

Case in point, reduced demand is not being seen in other parts of the world. Gains of 3.1% in the Americas and 5.1% across Europe and Africa are expected in 2022.13 Increased demand in these regions combined with fewer Chinese exports has maintained pressure on prices.

Indian Steel Returns to the World Market

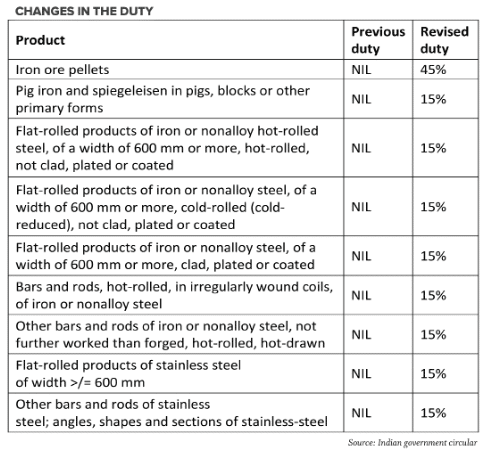

A further restriction in supply came during the months May through November when the Indian government employed a series of export tariffs on steel products in an attempt to protect the domestic market from inflationary pressures. The results were, instead, damaging to Indian producers.

Dependent on export sales, steelmakers such as Tata Steel, JSW Steel, Jindal Steel and Power, and Steel Authority of India reported poor third quarter results. Though net sales rose 7.9%, operating profit declined 69%, and net profit plunged 96% from a year earlier.”14

In response to pressure from steelmakers, the tariffs were lifted in November. If producers outside India saw some respite from competitive Indian exports while the tariffs were in place, they can expect the return of competition with this news.

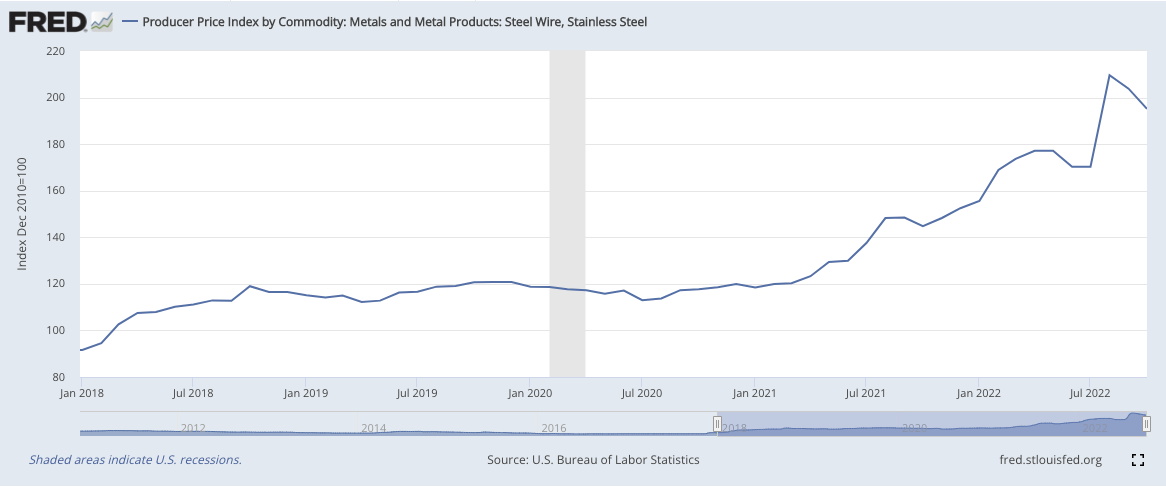

Pressure on Pricing Continues

While the market has seen a softening of late, the inflationary environment in which we find ourselves in 2022 is keeping prices sustained at higher levels. The figure below from the St. Louis Fed charts stainless steel prices over the past five years.15

Footnotes

1 (2022, March 1 and 2022, April 1). North American Stainless for Products Alloy Surcharge for Orders Promised for Delivery. North American Stainless. https://www.northamericanstainless.com/alloy-surcharges/

2 McHugh, D. (2022, September 6). Europe is facing an energy crisis as Russia cuts gas. PBS News Hour. https://www.pbs.org/newshour/world/europe-is-facing-an-energy-crisis-as-russia-cuts-gas-heres-why

3 (2022, December 12). EU Natural Gas. Trading Economics. https://tradingeconomics.com/commodity/eu-natural-gas

4 (9 November 2022). The rise and fall of European gas prices. MEPS International Ltd. https://mepsinternational.com/gb/en/news/the-rise-and-fall-of-european-gas-prices

5 (16 November 2022). Leeds stainless steel firm staff get thermals as heating is reduced. https://www.bbc.com/news/uk-england-leeds-63650900.

6 (12 December 2022). Henry Hub Natural Gas Spot Prices. U.S. Energy Information Administration. https://www.eia.gov/dnav/ng/hist/rngwhhdW.htm.

7 (1 November 2022). Stainless Steel Raw Material Surcharges for Orders Promised for Shipments October 30, 2022 through December 3, 2022. Cleveland Cliffs. https://d1io3yog0oux5.cloudfront.net/clevelandcliffs/files/pages/clevelandcliffs/db/1185/description/2022-11-Surch-SS.pdf

8 (6 December 2022). Short-Term Energy Outlook. U.S. Energy Information Administration. https://www.eia.gov/outlooks/steo/

9 (20 October 2022). Global stainless steel consumption changes. worldstainless. https://www.worldstainless.org/news/global-stainless-steel-consumption-changes/

10 (20 October 2022). Global stainless steel consumption changes. worldstainless. https://www.worldstainless.org/news/global-stainless-steel-consumption-changes/

11 (25 January 2022). December 2021 crude steel production and 2021 global crude steel production totals. worldsteel association. https://worldsteel.org/media-centre/press-releases/2022/december-2021-crude-steel-production-and-2021-global-totals/

12 Stainless steel meltshop production. worldstainless. https://www.worldstainless.org/statistics/stainless-steel-meltshop-production/stainless-steel-meltshop-production-2015-2021/

13 (20 October 2022). Global stainless steel consumption changes. worldstainless. https://www.worldstainless.org/news/global-stainless-steel-consumption-changes/

14 Jauhari, U. (17 November 2022). Pricing Challenges Likely to Persist for Steelmakers in Q3. mint. https://www.livemint.com/market/commodities/pricing-challenges-likely-to-persist-for-steelmakers-in-q3-11668626543717.html.

15 (12 December 2022). Producer Price Index by Commodity: Metals and Metal Products: Steel Wire, Stainless Steel. U.S. Bureau of Labor Statistics. Retrieved from FRED, Federal Reserve Bank of St. Louis. https://fred.stlouisfed.org/series/WPU10170502.

Note: To print this Market Brief, please click here.