Note: To print this bulletin on how to handle interlocked hoses, please click here.

Corrugated hoses have replaced their interlocked predecessors in all but a few special applications and, as a result, most conversations about metal hose are about the corrugated kind.

There’s talk of pressure ratings, discussions around chemical compatibility and consideration given to temperature derating factors. Examining hose failures has users assessing leaks, looking at cracks and debating the cause of braid damage.

None of these topics relate to interlocked hose.

With a different construction, interlocked hoses present users with a unique set of considerations. If they are more familiar with corrugated hoses, these could be helpful to point out.

Greater Design Capacity…Though with Limitations

Interlocked hose machines can be adjusted in many ways to make slightly different sizes and constructions. This ability to deliver a wider range of products also makes it difficult to control some characteristics from one run to another.

Sometimes a user might think the interlocked hose is too stiff, and other times too floppy. Or that it may too easily compress and extend on one occasion but prove too difficult on another.

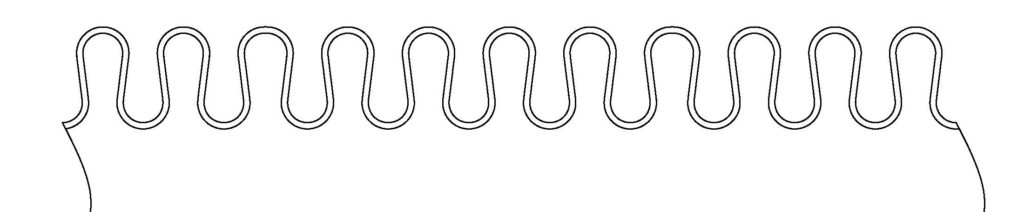

The manufacturing process is not the only contributing factor here. Consider the design of an interlocked hose. Movement is determined by how much the interlocked folds can move before hitting the nearest hose wall.

Without anything to “set” the slip space in place, compression and extension of the hose can happen during shipping, handling, installation and operation in a way that may not be consistent throughout the entire length of the hose.

This space, while necessary for movement, also means that interlocked hoses are not 100% leak tight. This is true even with the inclusion of special packing. This limitation created the need for a pressure tight solution, which eventually led to the development of corrugated hoses.

How to Handle Interlocked Hoses: Common Oversights

Sometimes users do attempt to put an interlocked hose in an application where a corrugated hose is better suited. Maybe the flow media is a liquid or there are high pressure requirements. When the hose leaks, the user may cite a failure, but the reason for failure would be an error in hose selection rather than a shortcoming of the hose.

The special packing that is sometimes included to reduce air loss or manage low pressure requirements in an interlocked hose is of a synthetic material. It can melt out of the hose if exposed to too high of temperatures, and this does present a challenge when welding on the end fittings.

Since metal can handle temperatures so much higher than the packing, sometimes users unknowingly subject an interlocked hose with packing to temperatures above design limits.

Also, with regard to the packing, if the hose sees a lot of compression and extension, it may try to “sneak out” of its position in the curve of the hose. In these cases the seal is lost and the user could expect to see some seepage.

Need for Lubrication

As an interlocked hose flexes, metal moves against metal. This contact can lead to material loss and shorter hose life which, fortunately, can be defended against with lubricants.

Lubricants reduce wear, thereby extending service life, and to remove them through, for instance, ultrasonic cleaning would be unwise. Without lubrication, an interlocked hose would be difficult to flex and produce an uneven bend, and the metal on metal movement would surely lead to premature failure.

The Big Don’t and a Unique Failure Mode

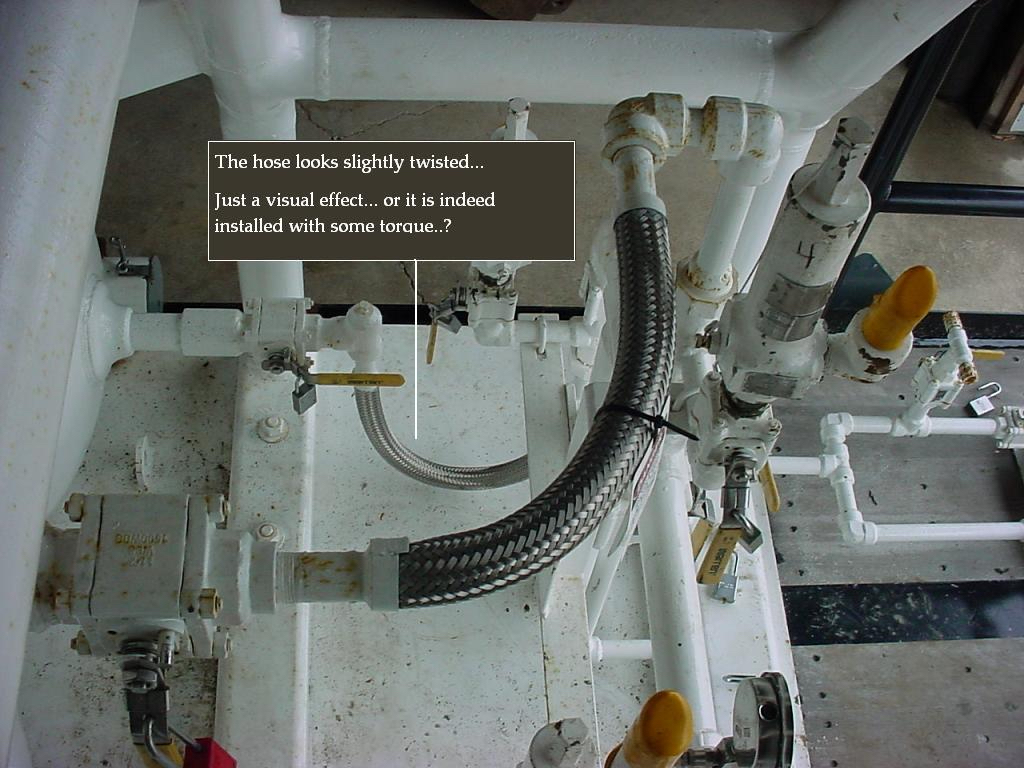

As with corrugated hose, torquing is a big “don’t,” though the result of torquing an interlocked hose is certainly unique. Twisting the hose will damage the interlocked connection, sometimes to the point of “unhooking” the folds. This can also happen if the hose is bent very far in excess of its minimum bend radius. In either scenario, once this happens, the hose will continue to fall apart.

One way to gauge whether an interlocked hose has experienced torque, assuming it’s not immediately visible, is to paint a “laying line” or “flow arrow” on the outside of the hose. If the line begins to swirl around the hose, the user will have evidence of twisting.

Use with Corrugated Metal Hose Assemblies

Thanks to the uniformity of the finished product and its pressure carrying capabilities, corrugated hose is the preferred option in most applications.

However, beyond the niche use cases, interlocked hoses continue to play an important role in the metal hose industry. They are often used as liners in or as protective armor on corrugated hose assemblies.

While liners manage flow velocity and protect the hose from the deleterious effects of flow-induced vibrations, armor acts as a bend restrictor and abrasion guard. While some users opt for short lengths of interlocked armor near the end fittings, if there is potential for over-bending, there’s a chance that the sharp edge of the short length of armor will end up digging into the hose. This is why other users opt for armor that runs the full length of the assembly.

The development of new products gives us a fresh set of solutions and challenges, but in the case of interlocked hoses with their continued use, some of the solutions and challenges associated with previous product iterations remain relevant.

To print this how to handle interlocked hoses bulletin, please click here.

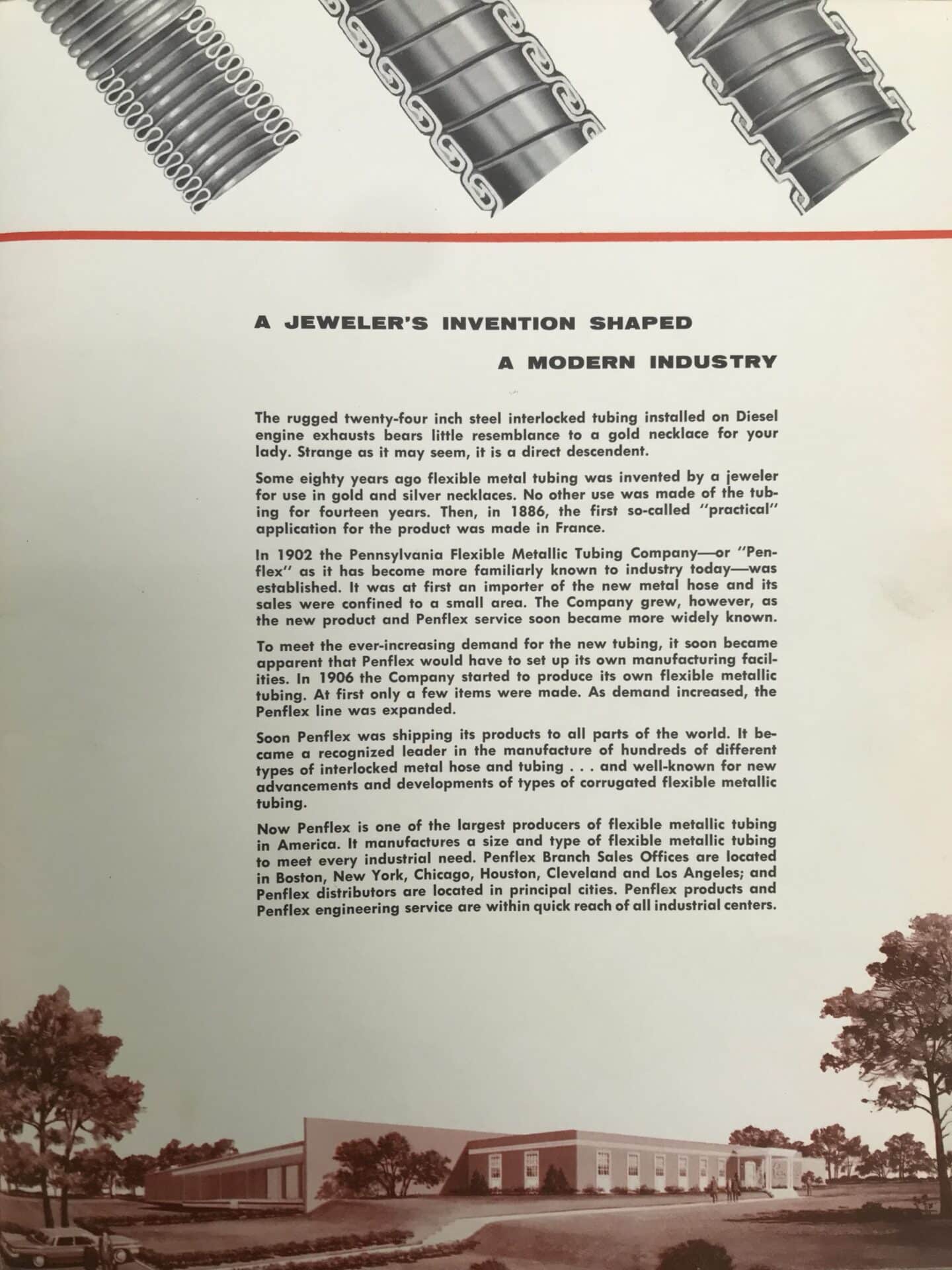

“The rugged twenty-four inch steel interlocked tubing installed on diesel engine exhaust bears little resemblance to a gold necklace for your lady. Strange as it may seem, it is a direct descendent.”

“The rugged twenty-four inch steel interlocked tubing installed on diesel engine exhaust bears little resemblance to a gold necklace for your lady. Strange as it may seem, it is a direct descendent.”

Further gains came with the introduction of Penflex’s

Further gains came with the introduction of Penflex’s

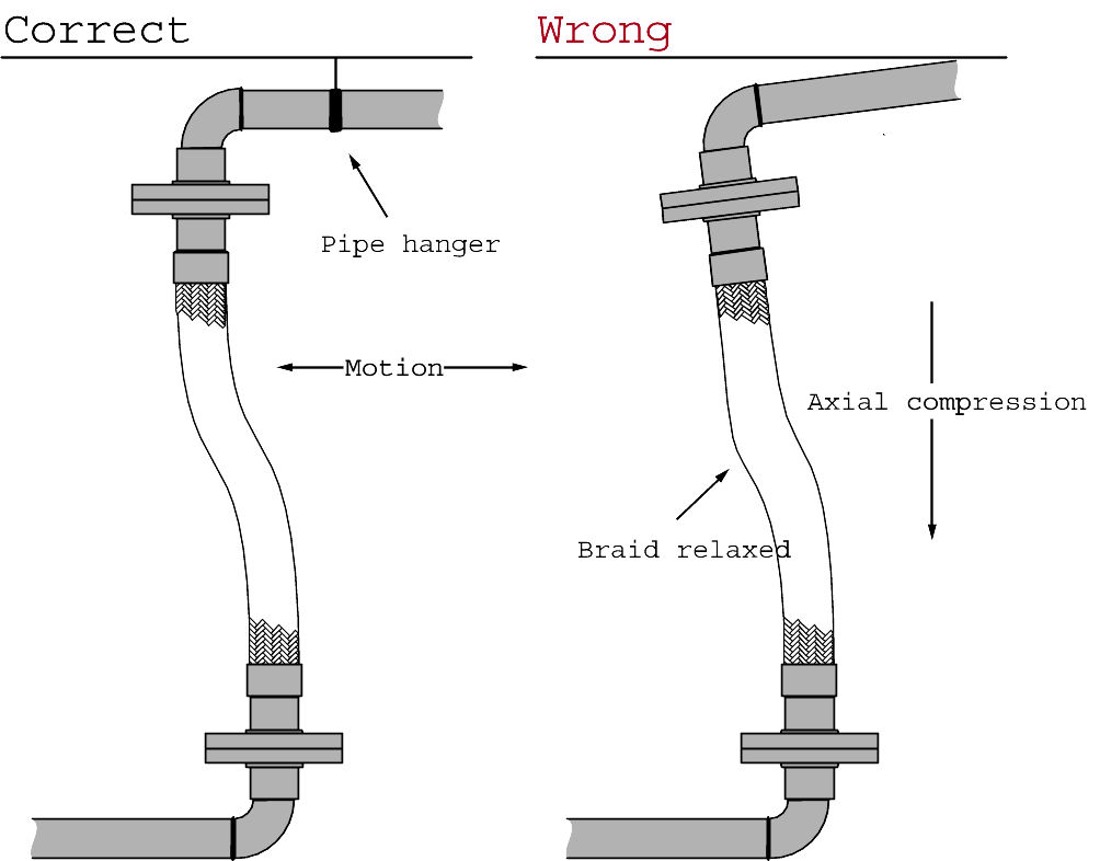

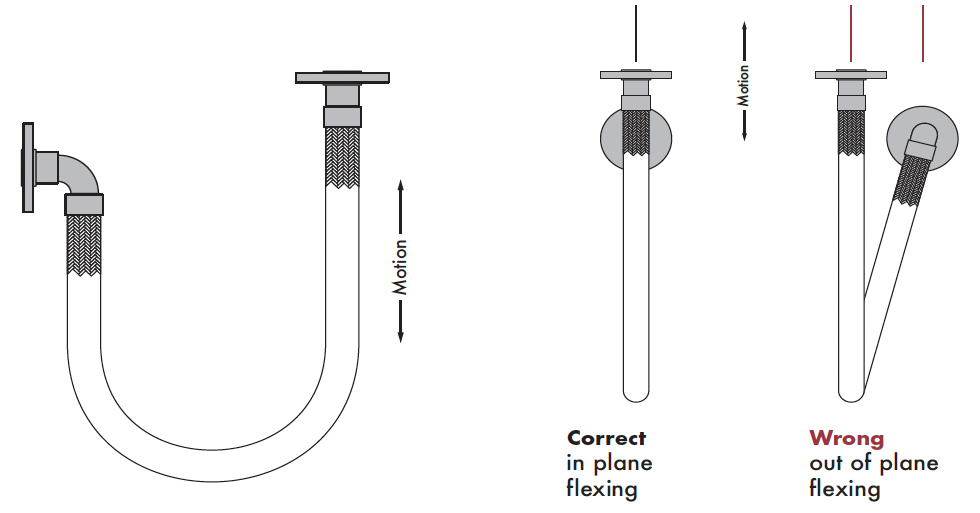

While braided hoses are pliable and seemingly capable of moving in many directions, they are not actually designed to accommodate all kinds of movement.

While braided hoses are pliable and seemingly capable of moving in many directions, they are not actually designed to accommodate all kinds of movement.